A stock market or an equity market consists of groups of sellers and buyers involved in selling and purchasing of stocks. The stock or share is an ownership claim on various companies registered on the given stock exchange. Investors can only invest in the stock market through middlemen called brokers. Nowadays, stock trading and investing is also carried out through electronic platforms such as eToro etc. Stock brokers provide various mediums to investors so that they can trade on the stock market. In addition to that, stock brokers also provide advice to their respective clients about their ideal investment strategies to make profits through stock market investing .

Young students can earn huge gains in the stock market. However, they have to keep in mind that it is a risky investment option. Therefore, they have to take utmost care while making an investment in the stock market.They have to make sure that they know important things about the stock market before jumping into the market. I think they should follow below given tips to become a successful investor in the stock market.

Educate yourself first

Young students must get some education about the stock market before jumping into the world of investing. They must understand that stock investing is not the game of unprofessionals. Therefore, they can’t take it lightly. Moreover, some people equate stock investing with gambling. However, this is not the case. Since successful stock investing needs in-depth market knowledge and intelligence . Motley Fool and Investopedia are two websites which have abundant information related to stock market and investment.

In addition to that, newbie investors could also improve their market knowledge by reading books by successful investors. Security analysis and the intelligent investor are two most well known books on stock investment. Benjamin Graham wrote these two books who was one of the most influential investors of the last century. Moreover, he was also the teacher of the most successful investor of the modern age Warren buffet.

Patience and stock market investing

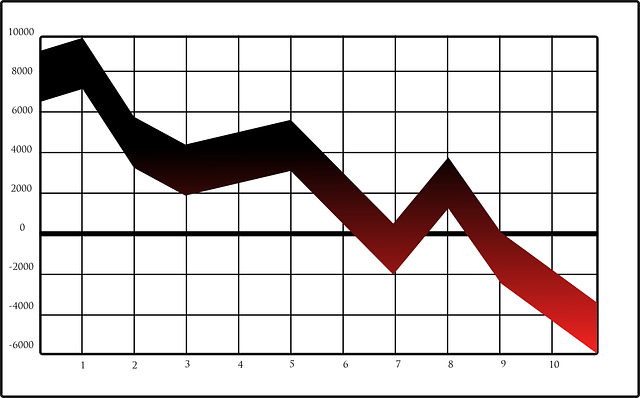

Patience is the most important quality of a successful investor. It helps when you are stuck in a stressful situation in the stock market . Majority of stock investors fail to control their emotions during a bearish trend. Therefore, they fall in the trap of panic selling and investors make huge losses.

Benjamin Graham is known as the father of investing. He was also a huge fan of patience. Benjamin Graham believed that investing and patience are natural partners. He used to tell his students that patience is the most important ingredient of long term successful investment strategy.

Dividend stocks help in stock market investing

Dividend stocks are high yielding shares who offer a consistent stream of income for their holders. Students mostly need money to finance their study or save money for their future. Dividend compounding through reinvesting dividends could be a very effective way of growing their wealth. For instance : If an investor is doing dividend compounding through dividend reinvestment of a dividend of 4% dividend yield with 3 % annual price growth. Then, dividend value will grow 7 1/2 times more than the original investment in next 30 years.

Old gurus help in stock market investing

Young investors can also take advice from their seniors. They should identify successful investors in their families and friends circle. These successful investors can guide young students to identify stocks of highly valued blue chip companies.

Young students can take help from online gurus. They are easily available on internet investing forums such as LinkedIn or facebook forums. They can guide about the latest trends in the stock market. This thing can be extremely useful for newbie young investors.

Crux of the matter

Stock market is a very good place for students to earn handsome bucks. However, they have to take care of some important things before jumping into the world of stock investing. First of all they must look for making an investment in fundamentally strong stocks. Moreover, they must try to create a diversified portfolio consisting of stocks belonging to different industries. It is important as it will help them minimize overall risk. Young investors can also look for geographic diversification as it is very beneficial for newbie investors.

Do you want solutions for your social and psychological problems?

Then Subscribe to our newsletter